How to Successfully Claim Roof Damage on Your Insurance in Melbourne

- Blog

- November 12, 2025

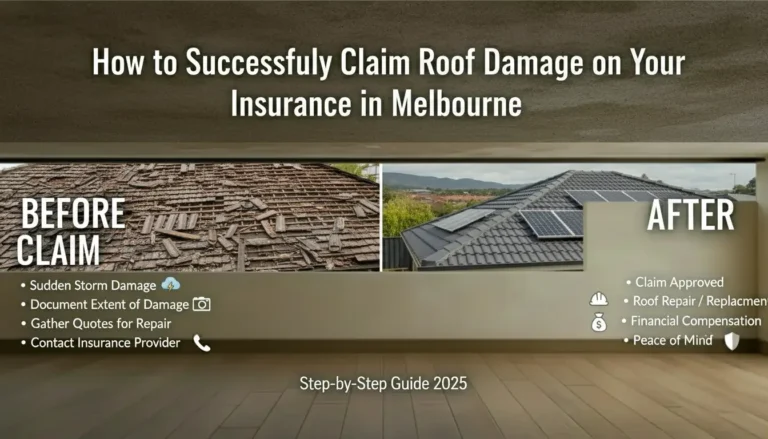

Dealing with a roof damage insurance claim can feel overwhelming, especially after Melbourne’s unpredictable weather has left your home vulnerable. Whether it’s storm damage, hail, or fallen branches, knowing how to navigate the insurance claims process can mean the difference between a smooth restoration and months of frustration.

Table of Contents

ToggleIn Melbourne’s northern suburbs, homeowners face unique challenges when claiming roof damage – from understanding what’s covered to working with insurance adjusters who may undervalue your claim. This comprehensive guide walks you through every step of filing a successful roof damage insurance claim, ensuring you get the coverage you deserve and your roof restored to perfect condition.

What Types of Roof Damage Are Covered by Home Insurance in Melbourne?

Understanding your policy is the first step to a successful roof damage insurance claim. Most Melbourne home insurance policies cover sudden and accidental damage, but exclude gradual wear and tear.

Typically Covered Roof Damage:

| Damage Type | Usually Covered? | Key Considerations |

|---|---|---|

| Storm Damage | ✅ Yes | Must occur during a single weather event |

| Hail Damage | ✅ Yes | Document size of hailstones if possible |

| Fallen Tree/Branches | ✅ Yes | From your property or neighbour’s |

| Wind Damage | ✅ Yes | Typically winds over 80km/h |

| Water Ingress from Storm | ✅ Yes | Must be sudden, not gradual leak |

| Lightning Strike | ✅ Yes | Including fire damage |

| Vandalism | ✅ Yes | Police report required |

Typically NOT Covered:

- Wear and tear from age

- Poor maintenance

- Pre-existing damage

- Gradual deterioration

- Lack of regular roof maintenance

- Cosmetic damage only

Expert Tip: “Many Melbourne homeowners don’t realise that insurance companies will deny claims if they can prove the damage existed before the storm. That’s why annual roof inspections are crucial – they provide dated evidence of your roof’s condition.”

📞 Need help assessing if your damage is covered? Contact Roof Restoration Northern Suburbs for a professional evaluation.

Step-by-Step: Filing Your Roof Damage Insurance Claim

Step 1: Ensure Safety First (Immediately After Damage)

Before you think about insurance:

- Move family members away from damaged areas

- Place buckets under active leaks

- If safe, cover exposed areas with tarps

- Document everything with photos/video

⚠️ Important: Emergency repairs to prevent further damage are usually covered, but keep all receipts.

Step 2: Document Everything (Within 24-48 Hours)

Your documentation makes or breaks your roof damage insurance claim.

Photo Checklist:

- ✅ Overall roof shots from multiple angles

- ✅ Close-ups of damaged tiles, flashing, or gutters

- ✅ Interior damage (ceiling stains, water marks)

- ✅ Fallen debris (branches, hailstones)

- ✅ Date-stamped photos if possible

- ✅ Surrounding property for context

Video Walkthrough: Record a detailed video explaining what happened, when it occurred, and showing all damage areas. This provides context photos alone can’t capture.

Roof Damage Insurance Claim Timeline

Your step-by-step guide from damage to approval

Damage Occurs & Safety First

Storm hits your roof causing visible damage. Your first priority is safety and preventing further damage.

- Ensure family safety

- Place tarps if safe to do so

- Move valuables from leak areas

- Take initial damage photos

Document Everything

Comprehensive documentation is critical for claim approval. This is your evidence.

- Take photos from all angles

- Record video walkthrough

- Document interior damage

- Save weather reports

- Keep all receipts

Call Professional Roofer FIRST

Get expert assessment before contacting your insurer. This prevents undervalued claims.

- Schedule inspection

- Get detailed damage report

- Obtain written quote

- Identify hidden damage

Notify Your Insurance Company

File your claim within policy timeframes. Late filing can result in denial.

- Call insurer with claim

- Provide documentation

- Submit professional quote

- Get claim reference number

Adjuster Inspection

Insurance adjuster visits to assess damage. Having your roofer present is recommended.

- Schedule inspection

- Have roofer present

- Point out all damage

- Provide documentation

Review Insurance Offer

Carefully compare the insurer's payout offer against your professional quote.

- Compare offers thoroughly

- Check scope of work

- Negotiate if too low

- Request re-inspection if needed

Claim Approved & Payment

Once approved, receive payment and schedule professional roof restoration.

- Accept final offer

- Receive payment

- Schedule restoration work

- Keep all documentation

Roof Fully Restored!

Professional restoration completed with warranty protection

Step 3: Call a Professional Roofer BEFORE Your Insurer

Here’s what most Melbourne homeowners get wrong: they call their insurance company first.

Why contact a roof restoration specialist first:

- Professional damage assessment – Insurers often miss hidden damage

- Detailed quote – Prevents lowball insurance estimates

- Expert documentation – Roofers know what evidence insurers need

- Negotiation support – Helps push back on unfair denials

A qualified roofing professional from the northern suburbs can identify damage an untrained adjuster might miss, including compromised roof valleys, failing repointing, or damaged flashing.

Real Melbourne Homeowner Story: “After a storm in Coburg, my insurer’s adjuster said only 10 tiles needed replacing. The roofing specialist I called found 47 damaged tiles, compromised bedding, and water damage under the valleys. That independent assessment saved me $8,000 in uncovered repairs.”

🔧 Get a professional roof damage assessment: Book Your Free Inspection

Step 4: Notify Your Insurance Company

Once you have documentation and a professional assessment:

When to notify:

- Most policies require notification within 30 days

- Some require 7 days for storm damage

- Check your specific policy

What to say:

- Stick to facts only

- Don’t speculate on causes

- Mention you have professional documentation

- Don’t admit fault for any maintenance issues

What NOT to say:

- “The roof was already a bit old”

- “We probably should have fixed that earlier”

- “It’s been leaking for a while”

Step 5: Meet the Insurance Adjuster

Critical tip: Have your roofing professional present during the adjuster’s inspection. This is your right as a policyholder.

What adjusters look for:

- Extent of damage

- Age and condition of roof

- Evidence of pre-existing issues

- Whether damage matches claimed event

Red flags adjusters use to deny claims:

- Poor maintenance history

- Age-related deterioration

- No proof damage was sudden

- Inconsistent homeowner statements

![Professional roofing inspector with clipboard examining damaged roof tiles, Melbourne suburban setting]](https://roofrestorationnorthernsuburbs.com.au/wp-content/uploads/2025/11/Professional-roofing-inspector-with-clipboard-examining-damaged-roof-tiles-Melbourne-suburban-setting.webp)

Step 6: Review the Insurance Offer Carefully

When you receive the payout offer:

Compare it against:

- Your independent roofing quote

- Scope of work proposed

- Material specifications

- Labour costs in Melbourne’s northern suburbs

Common underpayment tactics:

- Depreciating materials unfairly

- Missing damaged components

- Using cheaper material specifications

- Underestimating labour hours

If the offer seems low, you have the right to:

- Request a detailed breakdown

- Provide your professional quote as evidence

- Request a re-inspection

- Negotiate or dispute the decision

💼 Need help negotiating with your insurer? Our team has helped hundreds of Melbourne homeowners secure fair payouts: Get Expert Support

Common Roof Damage Insurance Claim Mistakes to Avoid

| Mistake | Why It’s Costly | What to Do Instead |

|---|---|---|

| Delaying the claim | Insurers may deny old damage | File within 7-30 days |

| No professional assessment | Miss hidden damage worth thousands | Get expert inspection first |

| Inadequate photos | Weak evidence = denied claims | Comprehensive documentation |

| Accepting first offer | Often 30-50% below fair value | Get independent quote, negotiate |

| Starting repairs too soon | May void claim | Get approval first (except emergency tarping) |

| Not reading your policy | Miss important exclusions | Review coverage annually |

Working With Insurance-Approved Contractors vs. Your Choice

Can you choose your own roofing contractor?

Yes! Despite what some insurers imply, you have the legal right to choose any licensed roofing professional, including specialists serving Melbourne’s northern suburbs.

Benefits of choosing your own contractor:

- Local expertise in Melbourne weather patterns

- Established reputation you can verify

- Direct communication throughout repairs

- Better quality control

- Relationship for future maintenance

When selecting a roof restoration and repair service in the northern suburbs, ensure they:

- ✅ Have current licensing and insurance

- ✅ Provide detailed written quotes

- ✅ Offer warranties on workmanship

- ✅ Have experience with insurance claims

- ✅ Can provide references from your area

🏆 Roof Restoration Northern Suburbs has helped hundreds of Melbourne homeowners navigate insurance claims successfully. See our previous work

What If Your Roof Damage Insurance Claim Is Denied?

Don’t panic. Claim denials are common, but many can be successfully appealed.

Common denial reasons:

- “Pre-existing damage” – Challenge with dated inspection reports

- “Wear and tear” – Prove damage was sudden and storm-related

- “Poor maintenance” – Provide maintenance records

- “Gradual deterioration” – Get expert testimony on sudden damage

Your options:

- Internal review – Request the insurer reconsider with additional evidence

- Independent assessment – Hire a licensed building consultant

- Dispute resolution – Contact the Australian Financial Complaints Authority (AFCA)

- Legal action – Consult an insurance lawyer (last resort)

Know Your Rights: Under Australian Consumer Law, insurers must handle claims fairly and efficiently. Keep detailed records of all communications.

Frequently Asked Questions About Roof Damage Insurance Claims

-

1. How long does a roof damage insurance claim take in Melbourne?

Typical timeline:

- Simple claims: 2-4 weeks from filing to payout

- Complex claims: 6-12 weeks

- Disputed claims: 3-6 months

Factors affecting speed include damage severity, policy type, and whether you have professional documentation ready. Having a detailed assessment from a roof restoration and repair service in the northern suburbs can significantly speed up approval.

-

Q2. Will my insurance premium increase after claiming roof damage?

Usually no for weather-related claims, as these are "no-fault" events. However:

- Multiple claims in 5 years may affect premiums

- Some insurers offer "claim-free" discounts you'd lose

- Check your policy's "claim impact" clause

Tip: Small repairs under $2,000 might be worth paying yourself to preserve your claims-free status for bigger issues.

-

Q3. Do I need three quotes for my roof insurance claim?

Not required by most Australian insurers, despite common belief. However:

- One independent quote helps verify insurer's estimate

- Having options gives negotiation power

- Choose a reputable local contractor over the cheapest quote

Focus on getting one comprehensive, accurate quote from a trusted specialist rather than rushing for three quotes.

-

Q4. Can I claim for emergency roof repairs immediately?

Yes! Most policies cover reasonable costs to prevent further damage:

- Tarp installation (keep receipts!)

- Temporary leak patching

- Emergency gutter cleaning if blocked

Always: Photograph damage before repairs, keep all receipts, notify insurer ASAP, and get permanent repairs approved before starting.

-

Q5. What if my roof is old - can I still claim damage?

Age matters, but isn't automatic denial. Insurers look at:

- Sudden damage vs. gradual: Storm damage to an old roof is still covered

- Maintenance history: Well-maintained old roofs have stronger claims

- Depreciation: Some policies reduce payout for older roofs

- Replacement vs. repair: They may only pay for repairs, not upgrades

Strategy: Regular roof maintenance and annual inspections create paper trails proving your roof was sound before the storm, regardless of age.

Melbourne-Specific Insurance Considerations

Northern Suburbs Storm Patterns

Areas like Coburg, Preston, Reservoir, and Greensborough experience:

- Severe summer storms with large hail

- High winds during spring and autumn

- Heavy rainfall causing leaking roofs

- Fallen tree branches during storms

Document local weather reports to support your claim – Bureau of Meteorology data showing severe weather in your suburb strengthens your case.

Get Expert Help With Your Roof Damage Insurance Claim

Filing a successful roof damage insurance claim doesn’t have to be stressful. With proper documentation, professional support, and knowledge of your rights, Melbourne homeowners can secure fair payouts and get their roofs properly restored.

Roof Restoration Northern Suburbs offers:

- ✅ Free damage assessments for insurance purposes

- ✅ Detailed quotes insurers respect

- ✅ Documentation support for your claim

- ✅ Direct communication with adjusters (when needed)

- ✅ Quality roof restoration backed by warranties

Servicing Melbourne’s northern suburbs including Brunswick, Essendon, Moonee Ponds, Bundoora, and beyond.

Don’t let insurance complications delay your roof repairs. Contact us today:

📞 Call Now for Your Free Roof Damage Assessment

🌐 Visit Our Website

📧 Request a Quote Online

Remember: The sooner you document and file your roof damage insurance claim, the better your chances of approval. Let Melbourne’s trusted roof restoration specialists guide you through the process.

Related Resources:

Need Professional Roof Help?

If you’re concerned about your roof’s condition, we’re here to help:

Discover how roof leaks can seriously affect your home and why immediate action is important

Schedule our professional roof and gutter cleaning service to prevent leaks before they start

Get expert assistance with leaking roof repairs across Melbourne

Explore our complete range of roofing services for all your roof needs

Contact us today for a free, no‑obligation roof assessment and quote.

If you want a thorough and safe roof cleaning, don’t hesitate to reach out to us for expert services. We can handle everything from roof cleaning to roof restoration.

- 0489 088 778

- info@roofrestorationnorthernsuburbs.com.au

- 32 Milleara Road Keilor East VIC 3033

- Mon-Sat : 8AM – 5PM